Executive Summary

August 2025 reflected continued strength across the global pharmaceutical and biopharmaceutical sectors. Regulators advanced a series of important approvals, partnerships and licensing activity remained steady, and modernization of regulatory approaches — particularly around AI/ML governance — moved forward. While no large-scale mergers were announced, the volume and diversity of transactions underscored a strategic preference for alliances and modular deal structures.

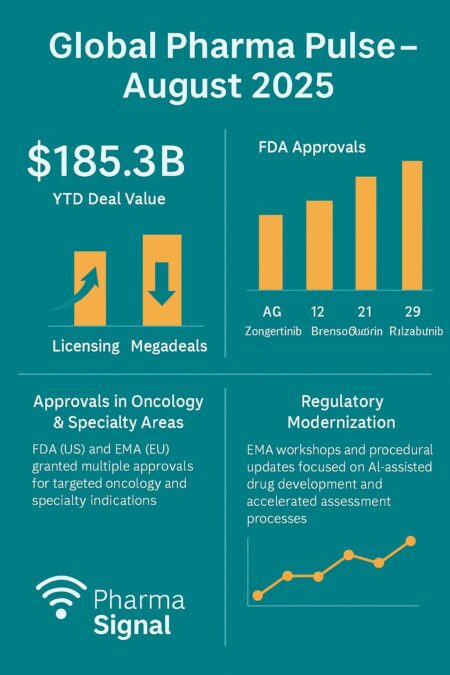

Quantitative Snapshot — August 2025

- Total disclosed deal value YTD: ~US$185B.

- Deal count YTD: 600+ transactions.

- FDA approvals in August: 4 therapies (oncology, respiratory, rare disease).

- M&A: <20% of total deal value; licensing and partnerships dominate.

- EMA activity: AI/ML workshops and accelerated assessment updates.

Dealmaking — steady activity without megadeals

By the end of August, disclosed deal value year-to-date had reached approximately US$185.28 billion. The majority of transactions were licensing agreements, collaborations, and bolt-on acquisitions rather than transformational mergers. More than six hundred transactions have been announced so far this year, with licensing accounting for the bulk of activity.

Importantly, deal structures are increasingly modular. Upfront payments are lower, while milestones and royalties linked to development and commercialization make up a larger share of total deal value. Geographic carve-outs and selective equity components are also common, reflecting a cautious but sustained appetite for innovation access.

Regulatory Approvals — precision and specialty therapies

The U.S. FDA cleared four notable therapies in August, reinforcing the dominance of precision oncology and rare disease in the global pipeline:

- Zongertinib (Hernexeos, Boehringer Ingelheim) — 8 August for HER2 non-squamous NSCLC.

- Brensocatib (BRINSUPRI™, Insmed) — 12 August as the first treatment for fibrosis bronchiectasis.

- Donidalorsen (DAWNZERA™, Ionis) — 21 August for hereditary angioedema prevention.

- Rilzabrutinib (WAYRILZ™, Sanofi) — 29 August for chronic immune thrombocytopenia.

These approvals underline how regulators are applying expedited pathways to therapies that meet clear areas of unmet need. They also demonstrate the commercial potential of specialty markets beyond oncology, such as respiratory care.

In Europe, the EMA continued its program of procedural modernization, with CHMP meetings in August emphasizing accelerated assessments and AI governance.

Therapeutic Area Patterns

Oncology remained the anchor for both regulatory activity and dealmaking, with targeted kinase inhibitors and molecularly defined indications leading the way. Rare diseases and immunology also sustained momentum, validated by the approvals of donidalorsen and rilzabrutinib.

An interesting development was the renewed visibility of respiratory disease. The approval of brensocatib for bronchiectasis opens a new category in chronic airway disorders, suggesting that specialty respiratory indications may offer new commercial and scientific opportunities.

Licensing & Partnerships — platforms and long-term plays

August deal flow continued the trend of large companies partnering for technology platforms rather than acquiring single assets outright. RNA technologies, antibody-drug conjugates, and AI-enabled discovery platforms were the most active areas.

Economic structures favored risk-sharing: upfront payments often accounted for less than one-third of potential deal value, with the balance distributed across milestones tied to pivotal trials, approvals, and commercial performance. Tiered royalties — sometimes reaching into the high teens or twenties — remain standard for late-stage assets. This approach provides optionality while keeping balance sheets flexible.

Regulatory Modernization — AI enters the mainstream

Regulators deepened their focus on digital technologies and evidence requirements. The EMA hosted workshops dedicated to AI and machine learning, specifically examining lifecycle governance, reproducibility, and transparency of algorithms used in development. The FDA, in parallel, advanced its consultations on AI-driven trial design and data provenance.

These developments illustrate that computational approaches are no longer peripheral but integral to regulatory science. Sponsors are expected to demonstrate rigorous validation and lifecycle management for digital methods, in the same way they would for physical assets or manufacturing processes.

Market and Policy Environment

The funding environment in August remained selective but supportive. Investors favored differentiated science, particularly platform technologies and late-stage assets with clear catalysts. At the same time, regional policy pressures — notably around pricing and reimbursement in Europe and Asia — continued to influence launch strategies and transaction terms.

These regional dynamics have become central considerations in structuring partnerships and determining sequencing for global launches.

Conclusion

August 2025 demonstrated the balance that now defines the global life sciences sector: steady flows of alliances and licensing rather than headline megadeals; targeted and specialty therapies driving regulatory approvals; and regulators embedding digital and AI considerations into mainstream development.

The long-term trajectory remains clear — innovation is being accessed through flexible partnerships, oncology and rare diseases remain the epicenter of activity, and new niches such as specialty respiratory care are emerging. Regulatory modernization ensures that AI, evidence generation, and regional policy complexity will continue to shape the sector in the months ahead.