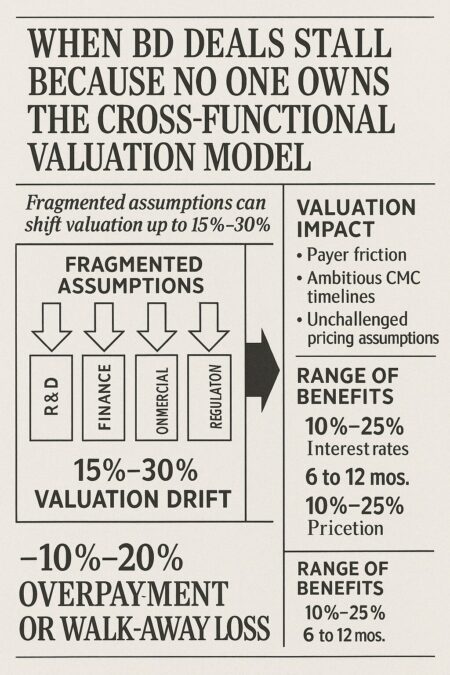

In most licensing auctions, the cross-functional valuation model becomes the silent failure point that no one admits to, driving a predictable 15–30% valuation drift and forcing BD leads into late-stage renegotiations that damage board credibility. When assumptions fragment across Functions, your risk isn’t theoretical — it’s a direct 10–20% overpayment or a blown walk-away moment that follows you for years. Join the Weekly Pharma BD Signals newsletter for execution checklists and deal-room breakdowns.

Where the Overpayment Drift Starts

Valuation drift begins the moment Finance, MAx, CMC, and Regulatory each build their own spreadsheets. No one disputes the science — they dispute timelines, payer friction, and COGS. The model stops being a decision tool and becomes a diplomatic exercise. Within weeks, your initial value corridor shifts by 10–25%, and the seller’s expectations rise accordingly.

The BD lead now negotiates against a number the internal team no longer believes. That is the exact point where deals stall or, worse, proceed with a silent premium no one has validated.

Internal Mechanics That Inflate Valuations

Three mechanisms account for most internal inflation:

- Unchallenged timelines: CMC routinely cuts 6–12 months off tech-transfer because the internal template forces optimism.

- Payer friction underestimation: Market Access assumes parity pricing without quantifying the regional corridor tightening of 10–25%.

- Regulatory clarity overstated: Teams collapse variance across agencies, producing a false single-pathway model that masks risk.

Each Function believes their inputs are “directionally right.” Combined, they create an EBITDA story that later underperforms by 20–40%, the exact gap boards cite when asking why the deal never paid back.

Commercial Impact of Auction Overpayment

Once your number moves, you rarely get it back. Sellers sense uncertainty and accelerate competitive pressure. Internal teams start rewriting scenarios to justify staying in the auction. That is how a 15–30% drift becomes an irreversible premium.

The downstream effect is tangible: launch budgets tighten, access timelines slip, and countries with weak price control—especially EM/CEE—compress margins through tender erosion of 15–25%. Your commercial plan spends its first 24 months absorbing a mistake made in week three of valuation alignment.

How Disciplined BD Teams Avoid It

High-discipline teams treat valuation governance as an operational process, not a spreadsheet. They lock Model Ownership on day one. They define which Function owns which assumption and which thresholds trigger a governance review. Nothing gets added without a documented source and challenger review.

Most importantly, they defend a walk-away value the same way they defend a forecast to the board. If the numbers move outside the corridor, the team escalates, not improvises. This is where BD reputations are built — or broken — over a single auction cycle.

Checklist for Your Next Licensing Auction

- Competitor capacity checks: Validate whether rivals can absorb accelerated timelines or higher COGS.

- Walk-away valuation locked early: Document the corridor and freeze deviation triggers before seller interaction.

- Payer friction quantified: Include scenario-tested price erosion curves, not point estimates.

- CMC risks costed: Assign explicit cost and delay probabilities to tech-transfer and scale-up windows.

- Evidence-based board walk-away logic: Use a briefing format that ties assumptions to sources, not internal optimism.

For launch-risk dependencies, see: https://pharmasignal.com/explainer-launch-readiness-risks

EM/CEE Reality Check

EM/CEE markets expose valuation drift faster than any other region. Access cycles extend unpredictably, tenders rebase prices aggressively, and distributors challenge assumed netbacks. A model built on US/EU logic collapses quickly, yielding 15–25% margin erosion before year two.

The only teams that avoid this are those that anchor valuation to verifiable payer mechanics, not internal optimism. When the model has a single owner — and every assumption has a challenger — the auction becomes a controlled process again. When it doesn’t, you pay for the drift twice: once in the deal, and once in the market.

Join the Weekly Pharma BD Signals newsletter for execution checklists and deal-room breakdowns.