The deal made sense on paper

At signing, the global deal thesis was tight. Clear rNPV logic, credible peak sales, realistic launch sequencing, and a partner narrative that aligned with portfolio strategy. Central BD and global commercial teams could defend every assumption. Management bought the story.

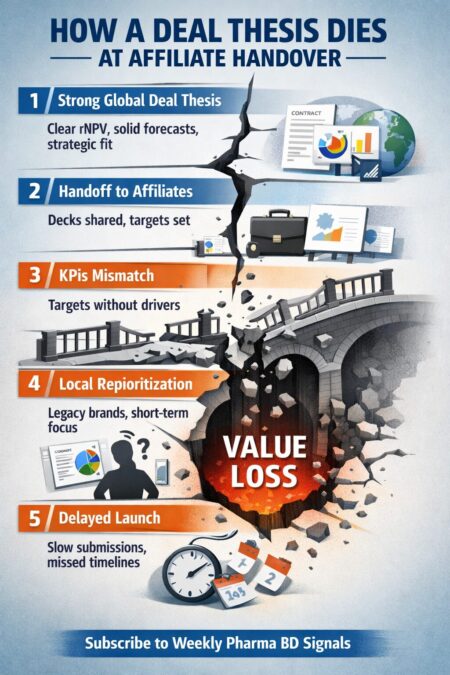

Then the asset moved from global governance to affiliate execution. That is where most deal theses quietly die.

Not because the asset failed clinically. Not because the contract was flawed. But because the value assumptions embedded in the deal were never translated into operating KPIs that affiliates could actually run.

Handover is treated as an administrative step

In most companies, affiliate handover is framed as a knowledge transfer exercise. Decks are shared. Assumptions are explained. Forecast models are circulated. The deal team moves on.

What is missing is accountability. The affiliate inherits revenue targets but not the logic behind them. The assumptions that drove valuation remain abstract. Price corridors, launch timing, tender exposure, field force ramp, and lifecycle sequencing are not converted into executable metrics.

The result is predictable. Affiliates optimize locally against their own KPIs, not against the deal thesis that justified the upfront and milestones.

Value assumptions rarely survive local prioritization

Within 6–12 months post-close, the asset is competing internally with legacy brands, regional priorities, and short-term P&L pressure. The deal thesis assumed focus. The operating reality delivers dilution.

Global BD may have assumed aggressive first-wave launches across priority markets. Affiliates, facing HTA uncertainty or tender-heavy dynamics, slow-roll submissions. Launch curves flatten. Early revenue that was critical to rNPV never materializes.

No one explicitly kills the thesis. It erodes through a thousand small decisions.

KPIs stop at revenue, not drivers

Most post-deal scorecards track net sales versus forecast. That is lagging and largely useless for course correction.

The original deal case was built on drivers: speed to reimbursement, price discipline versus reference markets, field force deployment, and line extension timing. These drivers are rarely hard-coded into affiliate KPIs.

Without leading indicators, underperformance is only visible 9–18 months later, when the launch curve is already broken and recovery options are limited.

Alliance governance does not bridge the gap

Joint steering committees tend to focus on compliance and high-level milestones. They do not translate global value logic into local execution metrics.

Partners assume affiliates will “figure it out.” Affiliates assume global overestimated the opportunity. This misalignment is rarely escalated until missed commercial milestones trigger uncomfortable conversations.

By then, 10–30% of modeled value has already evaporated.

What disciplined teams do differently

Teams that preserve deal value treat affiliate handover as a commercial integration step, not an information dump.

They lock a short list of non-negotiable operating KPIs directly tied to the deal thesis: submission timing, reimbursement sequencing, minimum launch investment, and lifecycle triggers. These KPIs are tracked alongside revenue from day one.

They also revisit the deal case at the affiliate level within the first two quarters, forcing explicit discussion on what assumptions will not hold locally and how value will be recovered elsewhere.

The real failure mode

Global deal theses do not fail because they were wrong. They fail because no one owns translating them into how affiliates are measured, incentivized, and managed.

When value logic stops at the global deck, revenue underperformance is not a surprise. It is the default outcome.

Subscribe to the Weekly Pharma BD Signals newsletter for execution checklists and post-close deal breakdowns.