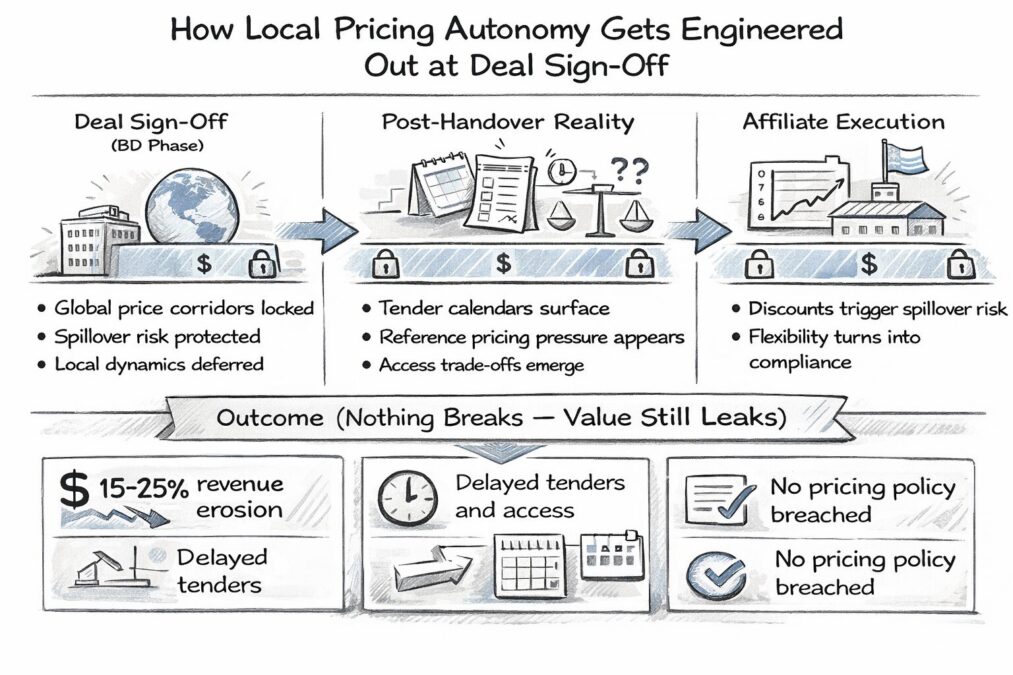

Local pricing autonomy rarely disappears overnight. It gets engineered out at deal sign-off.

At signing, global price corridors are locked to close the transaction. Local tender dynamics, reference pricing spillovers, and access trade-offs are consciously deferred. The assumption is that affiliates will manage these later. What affiliates actually inherit post-handover is a fixed pricing logic they did not shape.

Where pricing autonomy is really lost

The loss of flexibility happens structurally, not accidentally. Once global corridors are agreed, every local pricing decision becomes constrained by spillover risk elsewhere in the portfolio. Discounts stop being commercial tools and turn into binary compliance decisions.

Local teams can see tender realities coming, but they no longer have room to respond without triggering reference pricing consequences in other markets. The degrees of freedom disappear long before the first launch.

Why nothing breaks — but value still leaks

Formally, nothing goes wrong. Global pricing policies are respected. Approval pathways remain intact. Governance works exactly as designed.

Yet value erodes anyway.

We routinely see 15–25% of expected revenue disappear through forced discounts, delayed tenders, or quiet market exclusion — without breaching a single pricing rule. The system performs correctly. The economics do not.

The post-handover reality for affiliates

After handover, affiliates are asked to execute within a price logic that assumes optionality no longer exists. Tender calendars, competitor behavior, and reference baskets collide with corridor assumptions made months or years earlier.

Local teams are left optimizing execution, not strategy. When tenders are lost, the explanation is framed as market pressure rather than structural constraint.

Most of this was predictable at deal closure.

What BD teams underestimate at sign-off

During BD, pricing corridors are treated as closing tools. Tender dynamics are treated as downstream execution issues. The handoff assumes the two can be reconciled later.

They rarely are.

Once corridors are fixed, recovering flexibility requires formal exceptions, escalations, and risk acceptance that most organizations avoid. By the time the first tender is missed, the commercial outcome is already locked.

What disciplined teams do differently

More experienced BD and market access teams pressure-test pricing logic before signature, not after launch.

- They model tender exposure explicitly, not as sensitivity analysis

- They stress-test reference pricing spillovers across priority markets

- They involve local access teams early, before corridors harden

The goal is not perfect pricing. It is preserving decision space.

Local pricing autonomy is rarely taken away later. It is usually traded away early — quietly, rationally, and with full governance approval.

Subscribe to the Weekly Pharma BD Signals newsletter for execution checklists and post-close deal breakdowns.