In many specialty auctions, the phrase “strategic fit” becomes the justification for ignoring the SEO keyphrase — unmodellable COGS inflation — and accepting a 15–30% valuation drift that no board will forgive. BD teams feel pressured to close in 18–24 months, but weak CMC visibility during diligence routinely creates margin traps that destroy credibility within one reporting cycle. Join the Weekly Pharma BD Signals newsletter for execution checklists and deal-room breakdowns.

Where the Overpayment Drift Starts

The drift begins when BD relies on high-level integration narratives rather than quantifying raw material volatility, supplier concentration, and unvalidated scale-up assumptions. In 20–40% of mid-cap acquisitions, COGS visibility is so thin that teams model linear efficiency curves while ignoring batch failure history. The result is a silent 12–18% margin compression that only appears once tech-transfer exposure is irreversible. Boards interpret this not as market volatility but as BD governance failure.

Internal Mechanics That Inflate Valuations

Three mechanics dominate inflation: (1) CMC blind spots in early diligence; (2) overreliance on sponsor-provided cost baselines; and (3) absence of scenario stress-testing on 10–25% raw material swings. Teams often treat COGS as a fixed input, despite embedded fragility in yield variability and intermediary quality controls. Add 6–12 month tech-transfer delays and your IRR sensitivity breaks instantly. At this point, even disciplined BD teams will struggle to defend the acquisition price to audit committees.

Commercial Impact of Auction Overpayment

The commercial team is forced to chase revenue acceleration to compensate for cost blowouts. This typically introduces 20–40% EBITDA underperformance relative to the investment case, triggering urgent portfolio reprioritisation. Distribution partners push harder on margin, and tender markets reduce price corridors by 10–25% once local agencies see unstable supply schedules. Overpayment becomes a multi-year drag rather than a one-time accounting correction.

How Disciplined BD Teams Avoid It

The strongest teams lock walk-away logic before engaging in the data room. They require independent verification of yield stability, raw material cost indexing, CMO surcharge patterns, and historical process drift. They also integrate CMC risk ladders into valuation models rather than parking them inside technical annexes. This is the difference between losing 12–18% margin post-close and protecting board credibility.

Checklist for Your Next Licensing Auction

- Competitor capacity checks to map real manufacturing redundancy.

- Walk-away valuation locked early to prevent narrative-driven inflation.

- Payer friction quantified to expose 10–25% price corridor tightening risk.

- CMC risks costed including 6–12 month tech-transfer delay scenarios.

- Evidence-based board walk-away logic aligned with governance triggers.

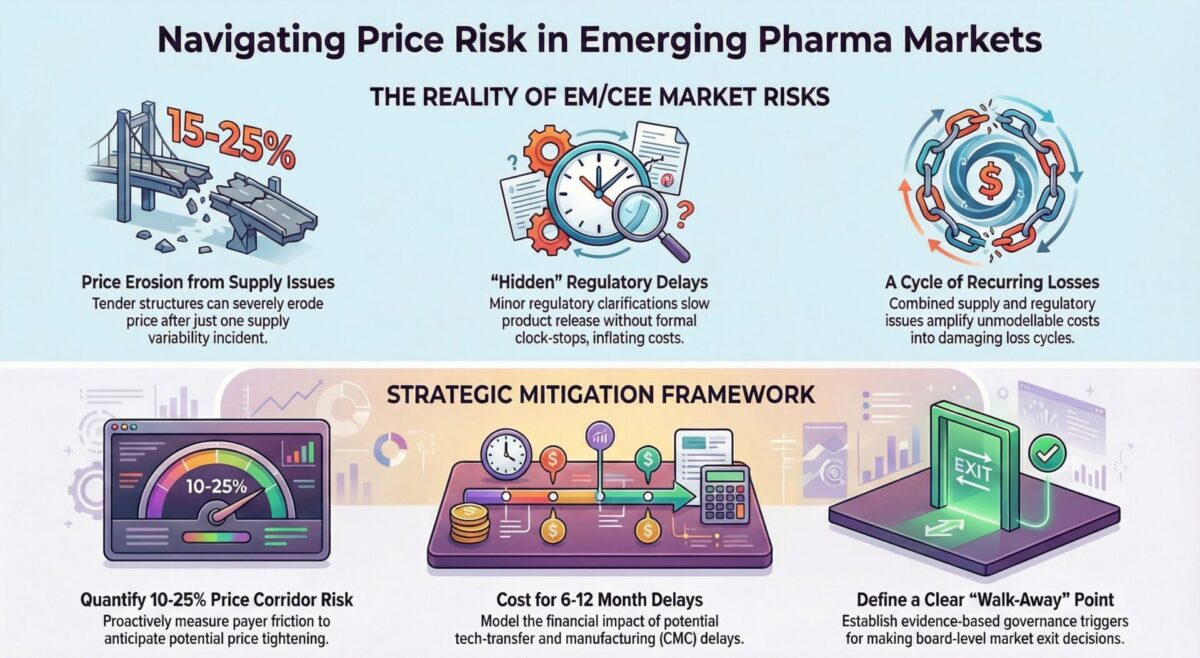

EM/CEE Reality Check

EM/CEE markets expose COGS modelling errors faster than EU5. Tender structures erode 15–25% of price if supply variability surfaces even once. Manufacturers also face regulatory micro-clarifications that slow batch release without triggering formal clock-stops. Combined, these mechanics amplify unmodellable COGS inflation into recurring loss cycles. For deeper operational risk patterns, see PharmaSignal’s explainer on launch readiness risk.

Join the Weekly Pharma BD Signals newsletter for execution checklists and deal-room breakdowns.