The filing was approved, so the risk felt behind

At the moment of approval, most central teams mentally close the chapter. The global regulatory strategy worked. Questions were answered. The label landed close enough to expectations. The asset moves forward.

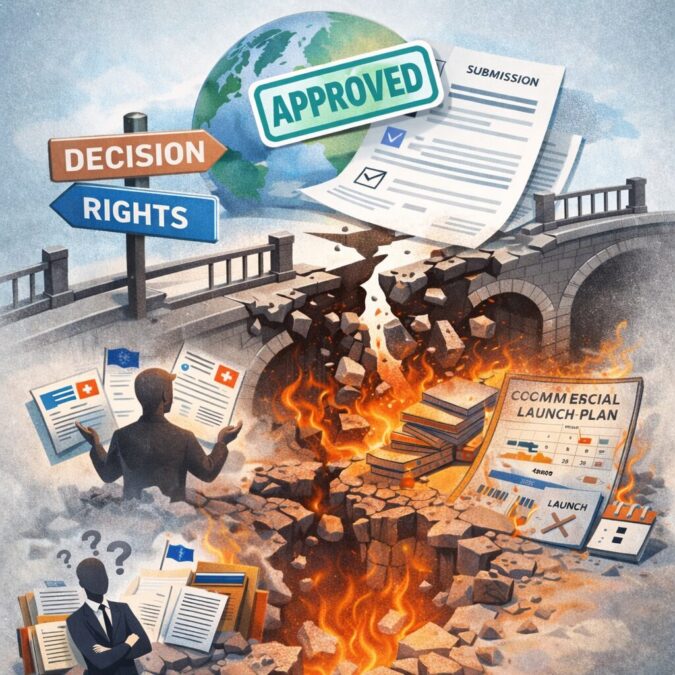

What follows, however, is one of the most common execution blind spots in pharma. Central regulatory disengages, regional teams take over, and an “approved” filing begins to quietly unravel.

Not because regulators changed their minds. But because decision rights, change control, and escalation paths were never operationally locked.

Approval is mistaken for alignment

Global approval is often treated as proof that regulatory alignment exists across regions. In reality, it only confirms that a specific dossier passed a specific authority.

Once central oversight steps back, regions interpret post-approval actions differently. Variations, safety updates, labeling changes, and local commitments are handled inconsistently. Each region believes it is acting within scope.

No single team owns the integrated regulatory position anymore.

Decision rights fracture immediately post-approval

During development, escalation paths are clear. Global regulatory leads. Trade-offs are debated centrally. Risk tolerance is explicit.

Post-approval, that structure dissolves fast. Regions assume authority over local variations. Central teams assume regions will stay aligned. Neither assumption holds.

Within 6–12 months, small, well-intentioned local decisions start to conflict. Commitments made to one agency constrain flexibility elsewhere. A change accepted in one market triggers questions in another.

Regulatory operations absorb the friction

When misalignment surfaces, it does not look strategic. It shows up as operational noise.

Clarification requests. Unexpected agency feedback. Duplicate justifications. Avoidable resubmissions.

Regulatory operations teams are left to reconcile divergent positions without a mandate to resolve the underlying governance issue. Timelines slip quietly, one interaction at a time.

Launch plans assume stability that does not exist

Commercial teams plan launches assuming the approved filing is a stable baseline. That assumption is fragile.

When post-approval changes trigger additional questions or require harmonization, launch sequences shift. Priority markets move. Tender participation is delayed. First-wave expectations no longer hold.

By the time the impact is visible, 9–18 months of momentum can be lost.

Why this rarely gets escalated early

No one wants to reopen governance after approval. Central teams have moved on to the next submission. Regions do not want to appear misaligned. Regulatory operations focuses on execution, not authority.

The cost of misalignment accumulates below the surface. Only when launches defer or milestones are at risk does the issue surface formally.

At that point, the fix is slower, louder, and more expensive.

What disciplined teams lock before disengaging

Teams that avoid this failure mode treat approval as a transition point, not an endpoint.

Before central disengagement, they explicitly lock post-approval decision rights: who can accept local agency commitments, what changes require global sign-off, and how cross-regional conflicts are resolved.

They also maintain a lightweight central regulatory spine for the first year post-approval, focused purely on alignment, not submission execution.

The real execution risk

“Approved” does not mean finished. It means governance must shift, not disappear.

When decision rights are unclear, regulatory operations becomes reactive, filings fragment, and launches defer for reasons no one modeled.

This is not a regulatory failure. It is an operating model failure.

Subscribe to the Weekly Pharma BD Signals newsletter for execution checklists and post-close deal breakdowns.